bank of canada prime rate

2009 Longest period of no change. The overnight rate is rate at which banks lend to each other.

Overnight Rate What It Is And Why It Should Matter To You Mortgage Approval Help

The prime rate in Canada is currently 245.

. Policy Interest Rate. Get quick access to data on exchange rates money markets inflation interest rates and bond yields. We explain what changes in the policy rate mean for you.

1 day agoThe increase in the prime rate which variable-rate mortgages are tied to will take effect on Thursday the lender said. All Bank of Canada exchange rates are indicative rates only obtained from averages of aggregated price quotes from financial institutions. 1 day agoRBC TD first banks to hike prime interest rate after Bank of Canada decision.

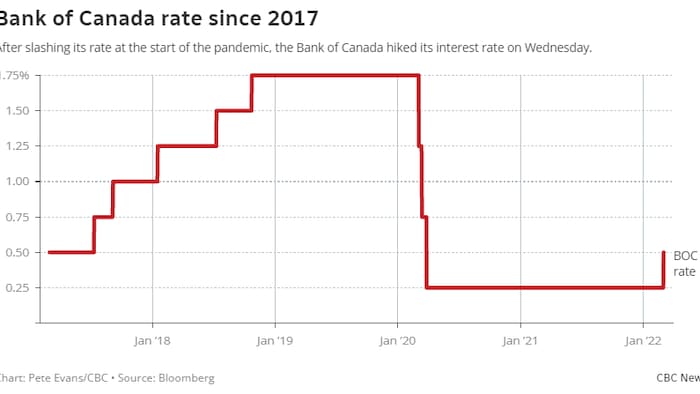

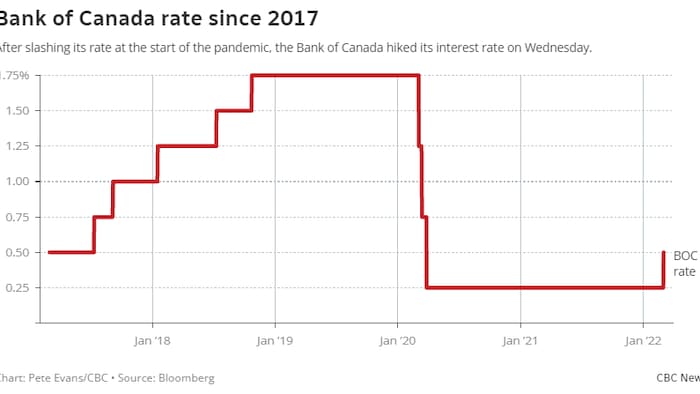

11 hours agoRBC TD and BMO lift prime rates to 27 after Bank of Canada hike Back to video The higher prime rate which variable-rate mortgages are tied to will rise to 27 per cent from 245 per cent and come into effect on Thursday the three lenders said. 1 day agoRoyal Bank of Canada Toronto-Dominion Bank and Bank of Montreal said on Wednesday they will raise their prime lending rates for the first time since October 2018 after the Bank of Canadahiked. 1 day agoThe Bank of Canada cut its key interest rate to the emergency level of 025 in March 2020 in an effort to help the economy weather the economic shock of the pandemic.

Prime Rate Advertising Disclosure. 1 day agoBank of Canada likely to hike key interest rate Wednesday The Bank of Canada is expected to boost its trendsetting policy rate which has been parked at. The central banks overnight interest rate sets the tone for the prime rates offered by banks.

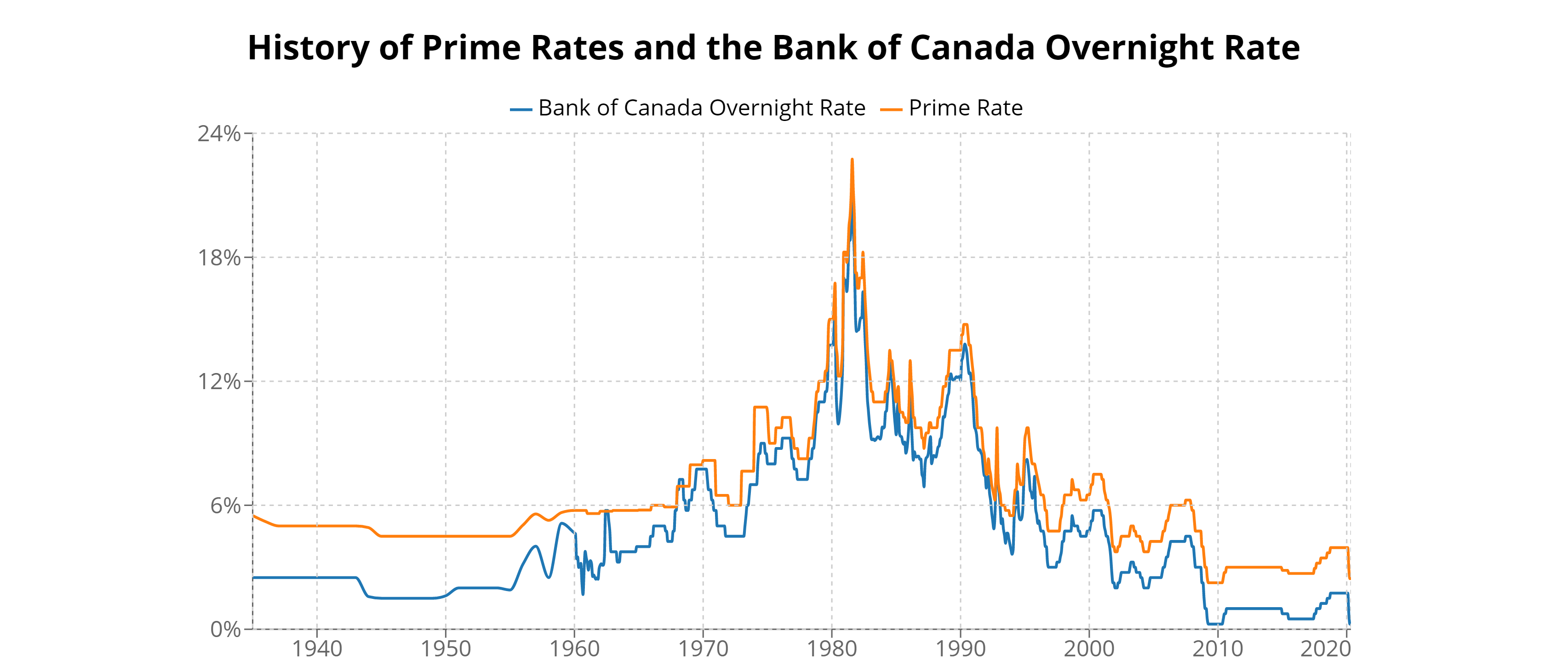

The Bank of Canada is the nations central bank. Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada. The Bank of Canada which sets the country.

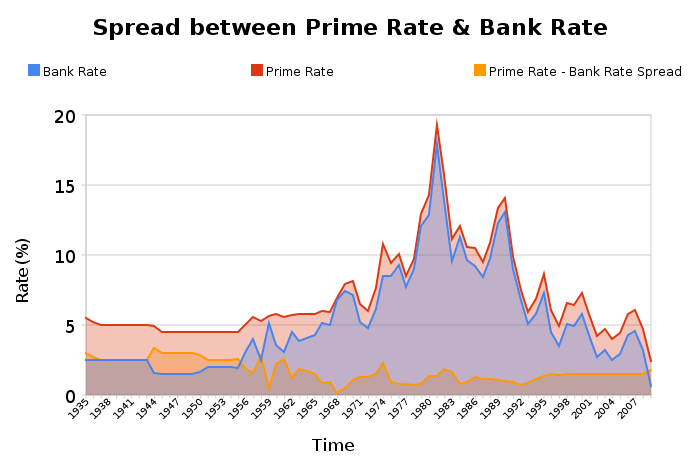

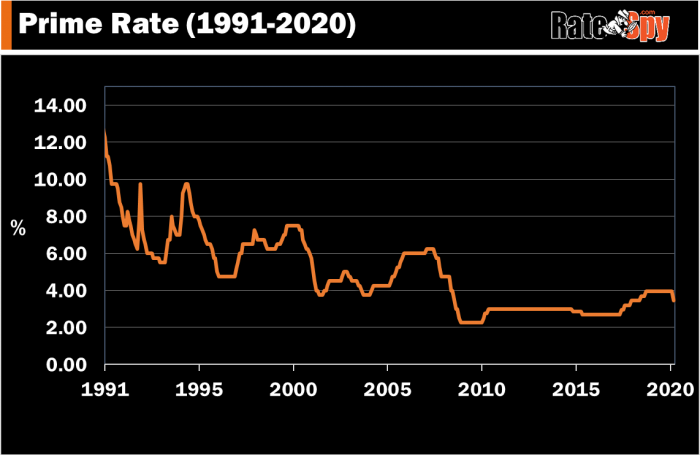

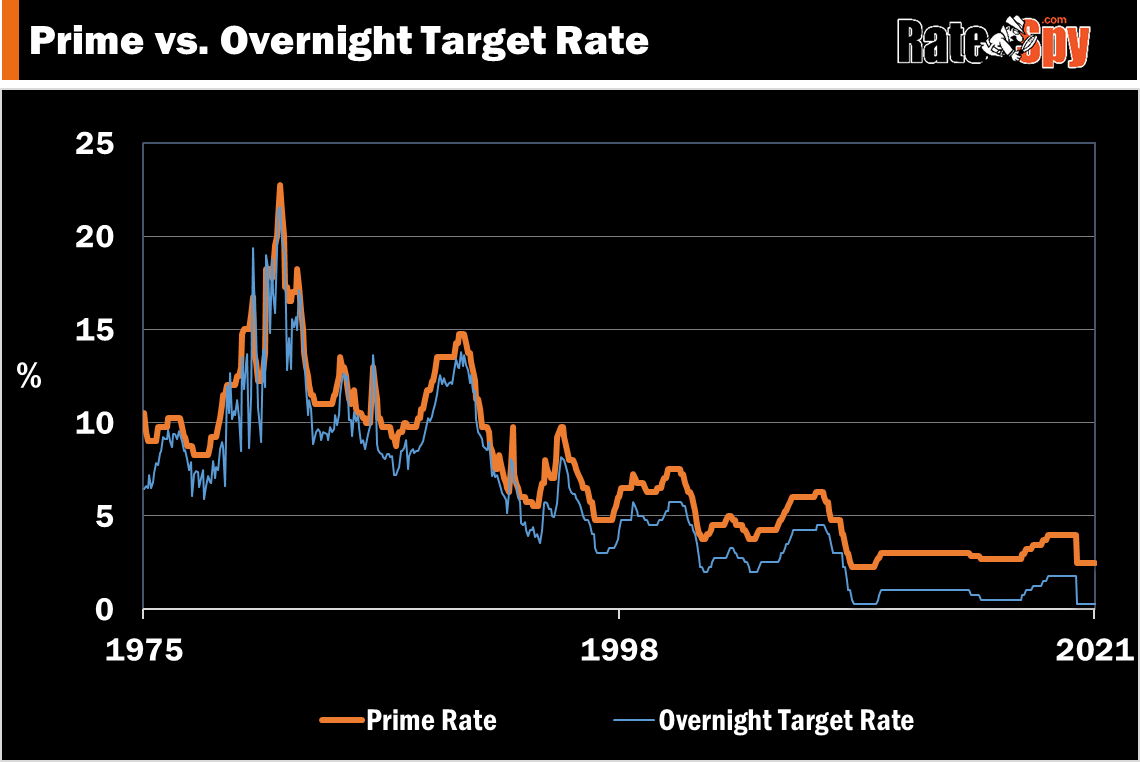

The prime interest rate fell from its previous level of 395 as the bank of Canada accelerated cuts to its overnight rate in order to boost the economy and minimize the financial impact of the pandemic. Historical Prime Mortgage Rate vs. The Bank carries out monetary policy by influencing short-term interest rates.

2015 Since the Bank of Canada started inflation targeting in 1991 the average Bank of Canada rate hike cycle has lasted 229 percentage points as measured from the trough to the peak as of September 2018. Since then the economy has. Bank of Canada Interest Rates.

From 2023 onwards the outlook is less certain and highly dependent on global macroeconomic factors. The prime rate has remained at 245 since it was cut three times in a row in early 2020 when the pandemic first hit Canada. The prime rate is driven by the overnight rate as set by the Bank of Canada.

For more information on the policy interest rate see this explainer. If youd like to access the data for the charts you can download that here. 1 day agoBy Nichola Saminather TORONTO Reuters - Royal Bank of Canada will increase its prime rate to 27 from 245 Canadas biggest bank said on Wednesday after the central bank raised its benchmark.

It does this by adjusting the target for the overnight rate on eight fixed dates each year. Updated April 23rd 2021. 1 day agoRoyal Bank of Canada will increase its prime rate to 27 from 245 Canadas biggest bank said on Wednesday after the central bank raised its benchmark rate by 25 basis points.

1 day agoCanadas Big Five banks RBC TD Bank BMO CIBC and Scotiabank all said they would increase their prime rates to 270 from 245 per cent effective March 3. Bank of Canada Interest Rate Forecast for the Next 5 Years. Our principal role as defined in the Bank of Canada Act is to promote the economic and financial welfare of Canada.

The prime rate also known as the prime lending rate is the annual interest rate Canadas major banks and financial institutions use to set interest rates for variable loans and lines of credit including variable-rate mortgages. The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products. As of January 2019 the Bank of Canada will no longer publish the daily weekly or monthly prime commercial paper CP or bankers acceptance BA rates.

Above we have predicted that the Bank of Canadas Target Overnight Rate will remain at 025 for 2021 and rise to 050 in 2022. For details please read our full Terms and Conditions. The Investment Industry Regulatory Organization of Canada IIROC will start publishing for informational purposes only the 1- and 3-month transaction based BA rates on the same date.

By Staff The Canadian Press Posted March 2 2022 405 pm. The Bank of Canada. Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management.

We are not a commercial bank and do not offer banking services to the public. The increase in. Canada Prime Rate is at 245 compared to 245 last week and 245 last year.

1 day agoRoyal Bank of Canada will increase its prime rate to 27 from 245 Canadas biggest bank said on Wednesday after the central bank. This is lower than the long term average of 724.

Blog Coldwell Banker Integrity Real Estate Cbci

Prime Rate Spread Simple Financial Analysis

Bank Of Canada Raises Key Interest Rate And Hints At More To Come

Prime Rate Wikiwand

Canada S Prime Rate Drops To 3 45 Ratespy Com

Interest Rates Are Going To Go Crazy Soon

What Is The Prime Rate In Canada Get Current Rate Rate History

Bank Of Canada Prime Rates 2020

Interest Rate Increase In Canada Onhike

October 2021 Market Update Kory Gorgani Real Estate

7mri6 94t8ffom

Bank Of Canada Interest Rate Outlook Consumer Confidence In The Dumps Financial Insights

Fichier History Of Prime Rates And The Bank Of Canada Target Overnight Rate Png Wikipedia

/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

The Federal Funds Prime And Libor Rates Definition